Grab your membership to get access to this indicator and many more

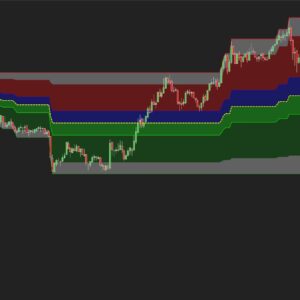

In trading, the consolidation zones are an important part of technical analysis, where there is no directional momentum in the market. During these periods, the market shows a lack of trend and often market sentiment suggests indecision among the participants.

The consolidation zones can be seen as a moment in the market, where it takes a break to make a decision for the next directional move. In other words, the consolidation zones can appear in the next situations:

- One, where there is no high volume in the market, the ‘big’ participants are not very active and the market is waiting for one of them.

- Or the second case, where both ‘big’ participants (buyers and sellers) are active in a market battle and their power is almost equal, at least for the moment.

In order to classify a consolidation zone, the indicator searches for these types of levels in the market, where indecision is present. The trader should keep an eye on the zones and wait until some directional momentum is present.